ANALYTICS

Diversification

Strategies

- Large numbers of small-value assets – over 10,000 to-date

- Geographical diversity

- Consumer preference diversity

- Asset resource diversity

- Strategic selection of markets with business-friendly environments

Market

Overview

- United States households spend $544 billion on auto financing annually, which is:

- 17% of annual household expense

- 9% of annual income

- Average annual cost per household is $4,147 / $467 per month

- 74% of United States households have one or more auto loans

- Markets currently represented in the Fund’s portfolio have just under $10 billion in auto loan activity annually

- Markets targeted in the next 18 months represent $31.5 billion

Portfolio Characteristics

- Loan amounts in the $10,000 – $15,000 range

- Strategic underwriting criteria

- Premium interest rates

- Use of leverage to maximize asset acquisition opportunities.

Performance

Return and

Risk Analysis

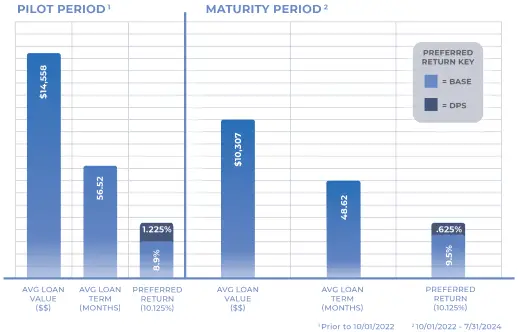

For the Fund’s initial period (“Pilot”), the characteristics of the acquired assets revealed, on average, a higher individual asset value, longer loan term and a lower Base return. Per the previous slide, those figures were, respectively, $14,558, 56.52 months and 8.9%.

The pilot data were analyzed and as a result, the Fund revised its

acquisition strategy which resulted in the following performance

enhancements (referred to as the Fund’s “Maturity Period”):

- A reduction in average individual asset value ($10,307)

- A reduction in average loan term (48.62 months)

- An increase in average base return (9.5%)

This strategy pivot enabled the Fund to further diversify the

portfolio and manage loss rate. The Fund has achieved a 10.125%

monthly return to investors since its inception and continues to offer a

Preferred Return of 10.125%. Knowing that strategy would evolve to raise the Base return, the General Partner has contributed a monthly Discretionary Profit Share (“DPS”) to meet the Preferred Return. Over the next 24-48 months, we anticipate a consistent Base return performance at or near 10.125%.

Risk Parameters

As with all debt funds, there are inherent risks that enable the Fund to return strong results for its investors. We believe that we have appropriate processes and analyses to monitor these risks on an ongoing basis.

Following is an overview of the risks we track, review and act on:

- Individual asset value variability

- Consumer preferences

- Local, state and federal regulatory activity as it relates to the asset class

- Note rate variability

- Borrower and asset underwriting criteria

- Geographic and demographic portfolio balance

- Technology change and disruption

- Staff sourcing, skillsets and development